Evaluation of the EU’s new steel policy from an economic perspective

The European Commission has recently issued two important industrial policies in succession – the “Steel Import Quota Adjustment Plan” and the “Steel and Metal Industry Action Plan”, building a policy framework driven by the “defense-transformation” dual-wheel drive. This policy combination aims to achieve three strategic goals through diversified paths such as strengthening trade relief measures, optimizing the industrial innovation ecosystem, and promoting low-carbon technology research and development: enhancing the resilience of the local steel industry chain, accelerating the green transformation of the industry, and alleviating the trade “shock wave” derived from the US “Inflation Reduction Act”.

From the perspective of market effects, although short-term import quota controls and anti-dumping measures can build a trade “breakwater” for European steel companies, their long-term economic effectiveness still needs to face the test of multiple variables. The ripple effect caused by this policy intervention may accelerate the reconstruction of the global steel market structure and form a new situation in which regional green trade alliances and emerging market capacity expansion are parallel.

Whether safeguard measures are beneficial to

Improving industrial competitiveness is controversial

The adjustment of the EU steel safeguard measures is essentially a protection for the domestic steel industry, but whether it really helps to improve industrial competitiveness is still controversial.

From an economic perspective, import restrictions usually lead to the following consequences: First, increase production costs. Trade barriers may cause the EU’s downstream industries (automobiles, machinery, construction, etc.) to face higher costs due to rising raw material prices, reducing market competitiveness. Second, there is a mismatch between supply and demand and inefficient resource allocation. The quota system may prompt companies to hoard resources or change their procurement strategies to circumvent quota restrictions, weakening the market’s price discovery function. Third, there is increased uncertainty in the global market. Such protection measures may trigger retaliatory tariffs from other economies, thereby exacerbating global steel trade frictions.

According to the “melted and poured” origin rules of the “Steel and Metal Industry Action Plan”, the EU plans to adopt the “melted and poured” standard in anti-dumping investigations, that is, the origin of the product is determined by the smelting place rather than the final processing place, in order to prevent tariff circumvention through processing in third countries. The rule stipulates that the origin of the product should be traced back to the smelting and casting links rather than the final processing place. This measure is intended to prevent tariff circumvention through “minimum processing” in third countries.

However, from an economic perspective, this policy may have the following impacts: First, it will increase the cost of supply chain management, and companies will need to increase traceability and certification costs, affecting supply chain efficiency. Second, it will weaken the processing business advantages of some countries. For example, the cold-rolled sheets and galvanized steel coils exported to Europe by Vietnam, India and other countries will be directly impacted. Third, the market concentration will increase. Large multinational companies will be more adaptable due to their complete supply chain, and the market competition pattern may change. This can also explain why steel companies with global production capacity layout such as ArcelorMittal are so supportive of the action plan, while some other European steel companies, such as SSAB (Swedish Steel Group) and ThyssenKrupp, have not shown the same enthusiasm.

The EU plans to expand the coverage of the carbon border adjustment mechanism to more downstream steel products to reduce the risk of “carbon leakage”. However, the adjustment of this policy will also face multiple challenges. On the one hand, the carbon border adjustment mechanism requires importers to pay carbon tariffs equivalent to the EU ETS (carbon trading system) price, but there are differences in emission calculation methods in different countries, and it is difficult to measure the carbon emission intensity of different countries; on the other hand, major steel exporting countries such as China and India may file a complaint with the WTO, believing that the carbon border adjustment mechanism has a protectionist color and may trigger trade disputes. In addition, this has a very limited incentive effect on low-carbon transformation. Without international coordination, the further implementation of the carbon border adjustment mechanism may only lead to adjustments in trade flows rather than promote carbon emission reductions worldwide.

China’s steel exporters will have more limited market options

The EU’s latest steel trade policy will bring a series of challenges to China’s steel companies’ exports, price competitiveness and low-carbon transformation.

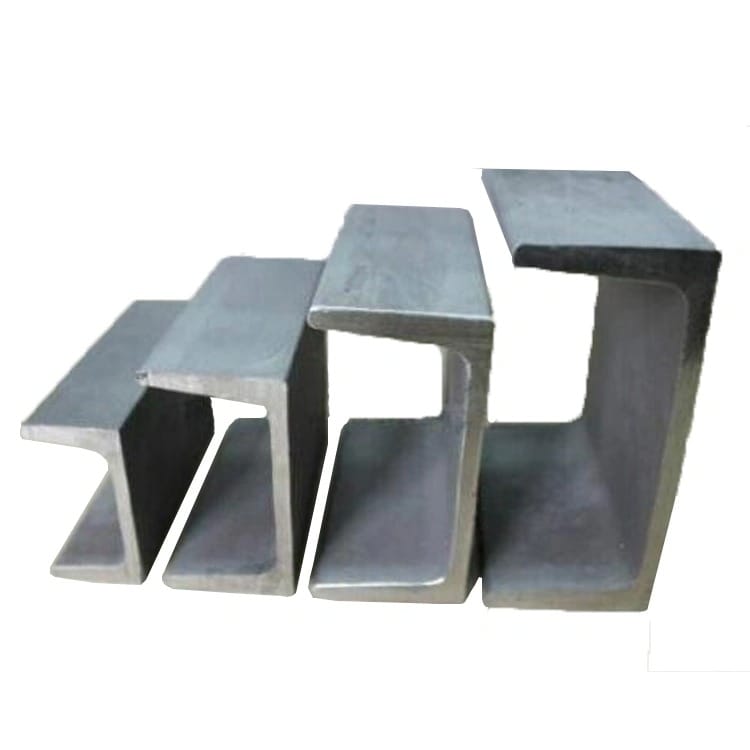

On the one hand, the further tightening of import quotas will directly squeeze the market share of Chinese steel companies in the EU, especially major export products such as cold-rolled and hot-rolled steel coils, galvanized steel coils, and wire rods will face stricter quota management. At the same time, the “melting and casting” rules of origin that the EU plans to implement may affect the model of Chinese companies processing and re-exporting to the EU through third countries, thereby limiting the feasibility of some products entering the EU market and making the market options of Chinese steel exporters more limited.

On the other hand, the decline in price competitiveness will become a major challenge for Chinese steel companies in the EU market. With the advancement of the carbon border adjustment mechanism, Chinese steel products will need to pay additional carbon tariffs to enter the EU market, and this cost will directly affect the price advantage of Chinese companies’ products. According to the current price level of the EU carbon emissions trading system (80 euros/ton ~ 100 euros/ton), the implementation of the carbon border adjustment mechanism is expected to significantly increase the export cost of Chinese steel products. This will not only affect the profitability of steel manufacturers, but may also force some companies to adjust their export strategies and turn to other markets to reduce their dependence on the EU market.

In addition, one of the core goals of the EU policy is to promote the development of “green steel”, which also puts higher requirements on the low-carbon transformation of China’s steel industry. At present, China is actively promoting the development of low-carbon smelting technologies such as hydrogen metallurgy and electric furnace steelmaking to reduce carbon emissions in the steel production process. However, Chinese steel companies still face certain challenges in technological innovation, financial support and market recognition. Although the Chinese government has introduced a number of policies to encourage the application of green smelting technology, large-scale low-carbon transformation in the short term still needs to overcome difficulties such as high technology research and development costs, insufficient infrastructure construction, and the green premium market has not yet been fully established. Therefore, in the context of the EU’s further strengthening of low-carbon emission steel policies, Chinese steel companies should not only pay attention to changes in trade barriers, but also accelerate their own technological upgrades to occupy a more advantageous position in future global market competition.

It is recommended that Chinese steel enterprises adopt a comprehensive and prudent strategy

Faced with the measures of the EU, the United States, Vietnam, South Korea and other regions and countries to increase import tariffs on Chinese steel products, Chinese steel enterprises must adopt a more comprehensive and prudent strategy to cope with changes in the global trade environment and ensure the long-term sustainable development of the industry.

First, give priority to strengthening capacity management and reasonably control crude steel production to prevent oversupply in the market and intensify international trade frictions. In recent years, the high output of China’s steel industry has increased the supply pressure in the international market to a certain extent. Some countries have restricted the import of Chinese steel products through anti-dumping, safeguard measures and increased tariffs. Faced with this situation, China should strengthen industry self-discipline, optimize the capacity structure, promote the transformation of blast furnace-converter long-process enterprises to short-process electric furnace steelmaking, reduce the addition of high-emission and high-energy consumption capacity, and ensure the sustainable development of the industry.

Second, accelerate product upgrading to enhance competitiveness in the international market. The demand for high-value-added products such as high-strength automotive plates, high-end stainless steel, and corrosion-resistant steel continues to grow in the global market. Steel enterprises should increase R&D investment, improve product technology content, and optimize production processes to reduce carbon emissions. As the global green supply chain is increasingly valued, low-carbon and high-performance steel will be more competitive. Therefore, China should accelerate the construction of the domestic carbon market, promote the connection with the EU carbon trading system, explore the carbon pricing mutual recognition mechanism, respond to the impact of the carbon border adjustment mechanism, and enhance the recognition of “green steel products” in the international market to avoid falling into the dilemma of low-price competition.

Third, strengthen incentives for low-carbon technologies such as hydrogen metallurgy and electric furnace steelmaking to promote the industry to move towards sustainable development. Countries and regions such as the EU and Japan have regarded hydrogen metallurgy as the core technology for future low-carbon steel manufacturing, and have provided a lot of financial and policy support. The Chinese government should accelerate the development of related technologies, encourage enterprises to invest in low-carbon smelting technology through financial subsidies, tax incentives, green finance and other means, and promote the green transformation of the domestic steel industry to meet the increasingly stringent requirements of the international market for low-carbon products.

Fourth, we need to be more cautious in overseas investment and avoid blind expansion. Although Southeast Asia is still the first choice for Chinese steel products and production lines to go overseas, in recent years, many regions around the world have faced the risk of overcapacity due to changes in demand. For example, Malaysia’s crude steel output increased from 2.8 million tons in 2017 to 8.8 million tons in 2024, with a compound annual growth rate of 17.7%. However, although Malaysia’s steel consumption has maintained steady growth from 2020 to 2025, its industrialization process has been basically completed, infrastructure construction has stabilized, and overall steel demand is difficult to recover to the peak of 2016-2018. According to the forecast data of the Malaysian Iron and Steel Industry Federation (MISIF), the growth rate of local steel consumption will slow down in 2024 and 2025. In view of this, it is recommended that Chinese steel companies fully evaluate local market demand, policy environment and production capacity when considering investing in the Southeast Asian market, so as to avoid overcapacity and investment risks caused by market saturation.

In summary, in the current process of changes in the global trade environment, the Chinese steel industry should adopt a more rational and diversified development strategy, strictly control domestic production capacity, accelerate product upgrades, promote the development of low-carbon technologies, and be cautious in overseas investment and layout to ensure that it occupies a favorable position in future global market competition.